Online Banking & Bill Pay

Online Banking

Provides convenient access to your member account information and account transactions using the Internet. Online Banking is an easy and convenient way to check your account balances, view account history, transfer funds, make cross-account transfers, verify cleared checks and deposits, and make loan payments. It’s easy and it’s free.

Bill Pay

Is an easy and safe way to pay your bills online directly from your credit union checking account. You control how much you want to pay and when you want the payment to be sent. You can set up recurring payments or a one-time payment. Payments on Bill Pay are limited to $5,000 maximum per payment. Bill Pay saves you time and money because it eliminates the need to write checks and buy stamps. Bill Pay is only $5.75 per month.

With the latest in security technology, you can be confident that your information is secure.

eStatement

eStatement

Receive your Americo FCU statement electronically, with our secure eStatement service. As an Online Banking user, you can view your statement electronically with Statement Express (eStatement). Statement Express will store six (6) months of previous eStatements. eStatement Service is a FREE service.

Mobile Money

Mobile Money

Mobile Money is a secure, convenient way to access your Americo FCU accounts anytime, anywhere, using your mobile device. With Mobile Money services you can view account balances, view account transactions, transfer funds between accounts and more.

Americo FCU does not charge for Mobile Money however, there may be charges associated with text messaging and data usage on your phone. Check with your wireless phone service provider for details on specific fees and charges that may apply.

*Americo FCU does not charge for Mobile Money, however **there is a $5.75 monthly fee for the Bill Pay service. There may be charges associated with text messaging and data usage on your phone. Check with your wireless phone service provider for details on fees/charges that may apply.

Americo Wallet

Americo Wallet

A mobile card management application that helps reduce account fraud by allowing cardholders to monitor accounts with their smartphone and control how, when and where their debit card is used.

Once Online Banking and Americo Wallet is set up, cardholders have the ability to “turn off” their card when not in use, establish transaction spending limits and decline a transaction when the amount exceeds a predefined threshold.

Real-time smartphone alerts can be customized based on the types of information each cardholder would like to receive. For example, a cardholder can set up an alert to be notified when a card is used, when a transaction is approved and exceeds any of the permitted use policies, or when a card transaction has been attempted but has been declined based on the parameters established.

Americo Wallet offers cardholders the capability of linking additional accounts to better monitor dependent spending. So, by using the GPS system in their smart phone, geographic use restrictions can be established for college students along with restrictions on merchant type and spending limits.

Americo Wallet is also ideal for small businesses. All transactions can be monitored or controlled for specific merchant categories, such as travel, restaurants or entertainment, and can be denied or reported for types of merchants deemed not business related.

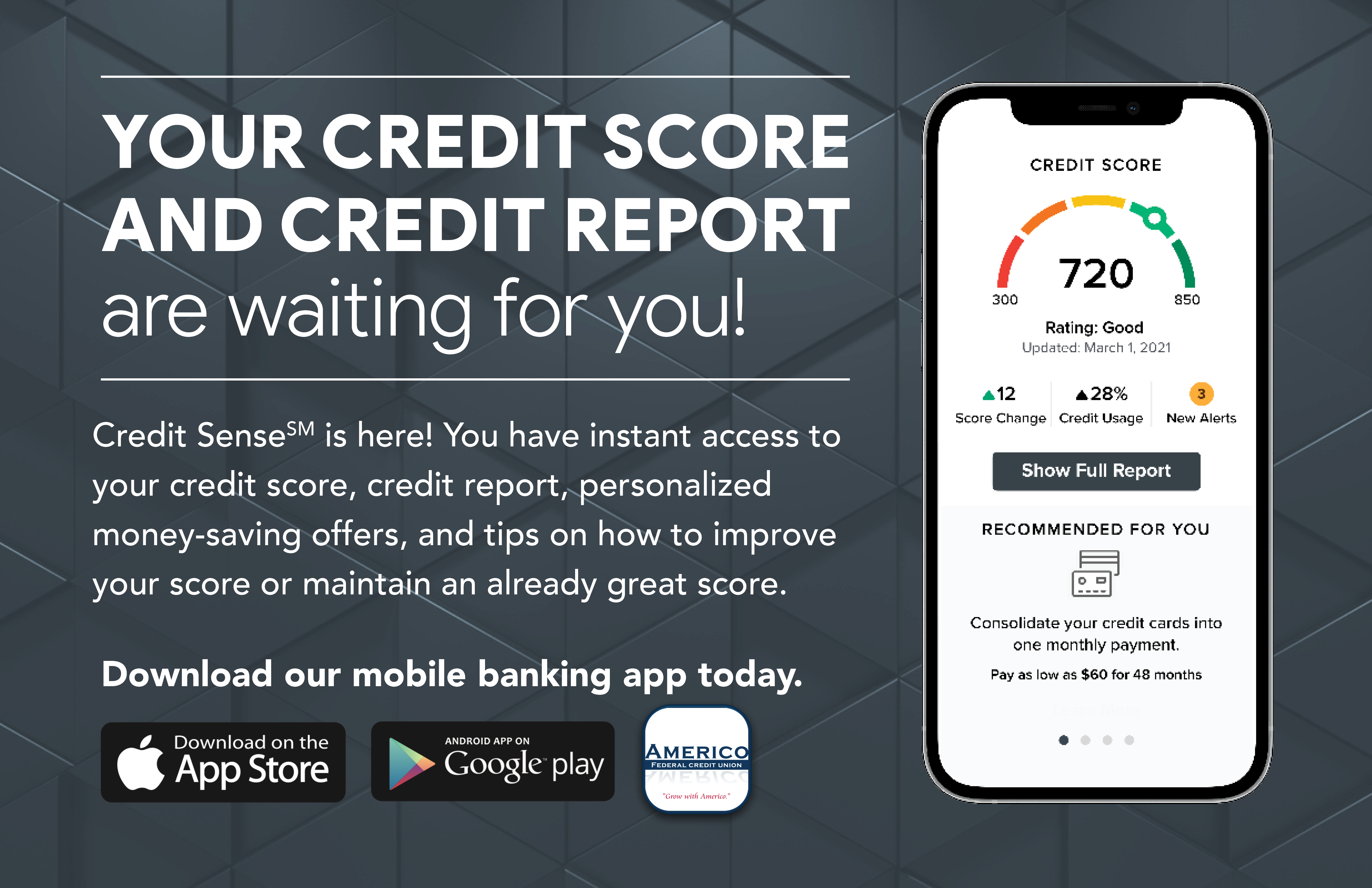

CreditSense